Customs Duty & GST on Car Imports (Australia)

When you import a car into Australia, two core charges apply to most vehicles:

Customs Duty and GST. Knowing how they’re calculated helps you budget properly

and avoid unhappy surprises at the wharf.

What are Customs Duty and GST?

- Customs Duty — a tariff on the car’s customs value. For most passenger vehicles it’s often around 5% (some categories can differ).

- GST — 10% applied to the Value of the Taxable Importation (VOTI), which is the sum of the customs value, duty, and international transport/insurance (plus a few minor government charges where relevant).

Note: Some vehicles may be subject to Luxury Car Tax (LCT) if they exceed the current threshold, and a few niche categories have different duty rates. We’ll flag those below.

How are Duty and GST Calculated?

- Work out the Customs Value (CV) — usually based on the transaction price of the vehicle (ex-Japan) excluding international freight/insurance.

- Calculate Customs Duty — commonly ~5% of the Customs Value (check your vehicle class).

- Build the GST Base (VOTI) — CV + Duty + international freight + insurance (and some minor government charges where applicable).

- Calculate GST — 10% of the GST Base.

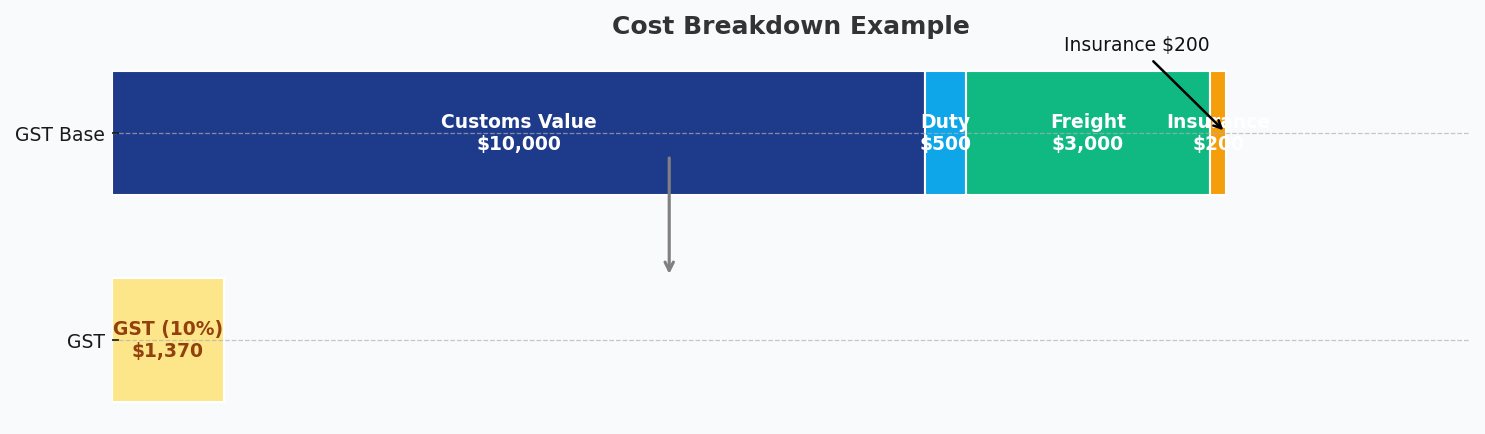

Example Calculation (Typical JDM Import)

Example only — real figures vary by model, exchange rate, route and season.

| Item | Amount (AUD) |

|---|---|

| Customs Value (car price ex-Japan) | 10,000 |

| Customs Duty (~5% of CV) | 500 |

| International Freight | 3,000 |

| Marine Insurance | 200 |

| GST Base (VOTI) = 10,000 + 500 + 3,000 + 200 | 13,700 |

| GST (10% of GST Base) | 1,370 |

Tip: budget an extra 10–15% buffer for port handling, quarantine, and compliance items that aren’t covered here.

What About Luxury Car Tax (LCT)?

LCT can apply if the car’s LCT value exceeds the current threshold. The rate and threshold change from time to time,

and there’s a higher threshold for fuel-efficient vehicles. If you’re close to the line, ask us to model it before you buy.

When Rates Differ

- Some commercial or niche vehicle categories may attract a different duty rate.

- Trade agreements and special exemptions can change outcomes in rare cases.

- Government fees (e.g., import processing charge, quarantine) sit outside the duty/GST formula and vary by arrival port.

Why Use Glam Groups?

- 22+ years’ experience handling import paperwork and tax calculations

- Upfront landed cost modelling so you know the real budget — no surprises

- We manage VIA, shipping, customs, quarantine and ADR compliance end-to-end

Get a Duty & GST Estimate

Want a quick, realistic estimate for your specific car? Call (03) 9303 7252 or request a Free Eligibility Check below.

This guide is general information only. Duty rates, thresholds and LCT settings change from time to time. We’ll confirm the current settings and calculate your exact figures before you proceed.